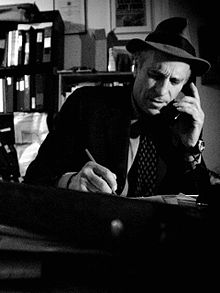

The transcript of Dialogos Radio’s interview with investigative journalist (BBC, The Guardian) and New York Times bestselling author Greg Palast. This interview aired on our broadcasts for the week of January 29-February 4, 2015. Find the podcast of this interview here.

The transcript of Dialogos Radio’s interview with investigative journalist (BBC, The Guardian) and New York Times bestselling author Greg Palast. This interview aired on our broadcasts for the week of January 29-February 4, 2015. Find the podcast of this interview here.

MN: Joining us today here on Dialogos Radio for the Dialogos Interview Series is one of our regular and most prominent guests, investigative reporter and bestselling author Greg Palast, who is the author of books such as Vulture’s Picnic, Armed Madhouse, and The Best Democracy Money Can Buy, among others. Greg, thanks for joining us once again.

GP: You’re very welcome, Michael.

MN: Let’s get right to the heart of the issue: there’s many people both inside and outside of Greece who have placed their hopes for the end of austerity with SYRIZA, and SYRIZA is often described as a radical left-wing party, yet the party’s official platform, even despite its promises for ending austerity and rolling back a lot of the measures that have been enforced, eliminates even the consideration of a Greek exit from the Eurozone. What do you make of these proposals?

GP: Well, SYRIZA is of course the main voice against the madness of austerity, and that’s made them popular, and then also from the point of view of my fellow economists, I’m an economist by training, 90% of economists think that austerity is religion, not economics. You don’t cut your budgets in the middle of a depression, which is what you have. So I mean, they’re talking reason. The problem is that there is a consensus among the Greek elite, the European elite, the world financial elite, that the sky will fall if the Greek people leave the euro. If Greece exits from the euro, the “grexit,” as they’re calling it, that’s doom and gloom, and therefore, SYRIZA is picking up the same language that “we’re not going to leave the euro, don’t worry, because we can end austerity, we can tell the Germans to back off, the troika to back off, and they’ll understand that austerity is self-defeating, but we’re not going to leave the euro if they don’t agree, or they’re not going to kick us out.” And that, of course, is fantasy island, because what, to me, SYRIZA misunderstands is that the euro is the disease, it is not the solution, it’s not the cure. In other words, they want to do two things, SYRIZA wants to do the impossible, which is to get rid of the austerity that comes with the euro, and yet keep the euro. They want to cure themselves of leprosy but they don’t want to leave the leper colony, and that’s impossible.

MN: Let’s talk for a bit about the history of the euro for a moment…you’ve mentioned in past interviews and articles that you knew the founder of the euro, economist Robert Mundell. Tell us about the economic world-view of Mundell and what his views were in giving birth to the idea of the European common currency.

GP: Mundell, who taught at Columbia University, he’s still alive and still teaching, by the way, won the Nobel Prize for his writings on currency, and what’s interesting, by the way, is that he won the Nobel Prize for the theory of optimum currency areas, and he had a theory that nations should join currency unions when they have similar economies. Therefore, agriculture economies should have a joint currency, he thought the U.S. and Canada have two different currencies, east-west, not Canadian-American, but the Western U.S. should have one currency with Canada and Eastern Canada and the Eastern U.S. should have one currency. In other words, he believed that a combination, like putting Germany in the same currency zone as France and Spain, would be ridiculous, it’s a violation of his core theory through which he won the Nobel Prize. Why is this important? This is the very same guy who is the inventor, you could say, of the euro, which he called the “Europa,” that there should be one single common currency for all of Europe, damn the optimum currency theory. Now why would someone suggest a currency which is exactly the opposite of everything he’s everything taught? So I spoke to him about this, because he was a friend of my professor, Milton Friedman, the kind of “god” of the free market economic school, monetarism, so I spoke with Mundell at length about why the “Europa,” as he called it, why the euro, and he said that it has nothing to do with creating a good currency. It has everything to do with changing the politics of Europe. He was very, very right-wing. He is the creator of another economic theory, which wouldn’t get him the Nobel Prize, in fact it’s called “voodoo economics,” supply-side economics. That is, the more you cut taxes, the more tax revenue you get. The more deregulation of business you get, the better your economy. And the less risk, in other words, if you deregulated the banks, there would be less risk in the banking system. All of those supply-side systems, which we call “Thatcher economics,” “Reagonomics,” after Ronald Reagan, it’s all been discredited, it’s all called “voodoo economics” these days, and yet, that’s what the euro is. It’s an instrument of voodoo economics, because what he said is, the euro, and this is important, by having one currency for Europe, and with it, a rule–remember, with the euro comes the rule that you cannot have more than a 3% deficit or 60% of debt compared to your gross domestic product–almost no deficits. That means that no nation, because you don’t have your own currency, has any control over monetary policy. Your nation has no control over fiscal policy. Your nation has no control over your currency exchange rates. Basically, you lose complete control of your financial system, and he said “it gets rid of the meddling of parliaments and congresses and governments to fool around with fiscal and economic policy.” What he meant is that democracy gets in the way of good economics. So, what happens when you get rid of democracy? He says, “that leaves government only one choice,” the only choice when there’s a crisis, as we have now. When there is a crisis, governments will eliminate labor union power, will eliminate government regulation, will privatize its industry, its power companies, its water companies, because they’ll need to pay off their debts, and basically, the power of government and labor unions, the working class, those powers will be eliminated, and wages will fall. In order to maintain employment, governments will allow wages to fall and regulations to die. In other words, this crisis, in Mundell’s terms, is what he had planned and what the creators of the euro had planned. Crisis is part of the euro plan, a crisis which would cause a realignment between business and labor in Europe, and that the welfare state of Europe will be destroyed, and that’s exactly what has happened. What you’re seeing now, with the collapse of the southern European economies, including Greece and Spain and Portugal, what’s happening here was part of the euro plan. This was not a mistake, this was not something that they tried to avoid. It is what they wanted to happen, a crisis which would cause a realignment of political power and the end of the European welfare state. By the way, the end of the European welfare state caused by a crisis is a quote from Mundell. That’s exactly what he told me and I have it on tape.

MN: We are speaking with investigative journalist and bestselling author Greg Palast here on Dialogos Radio and the Dialogos Interview Series, and Greg, returning to the situation at hand specifically in Greece, we’ve heard a series of contradictory statements recently from German and European Union officials regarding whether a country can even depart from the Eurozone or not. What is applicable, if you are aware, legally, in terms of a member-state departing from the Eurozone, and does a country like Greece even need to worry about what official policy might be on this issue?

GP: Well, the great irony is that it may actually be impossible for Greece to stay in the Eurozone, without there being a massive change in rules. You can’t have more than a 3% deficit to stay in the Eurozone, and that’s impossible for Greece, because no nation in depression can or should, avoid a deficit in government spending. The United States, to recover from our great recession, went and borrowed 9, 10, 11% of gross domestic product. We flooded our economy with $4 trillion in cash through our central bank, and we had over a trillion dollars, way over a trillion dollars, in deficits in a year and a half. It was massive, and that’s how the United States got out of this recession. China went into a massive fiscal deficit and a massive release of funds from its central bank into its system. It’s the only way to survive. Now, if Greece doesn’t do this, if Greece sticks to this current business of having a functional surplus, you will continue to see the destruction of your economy, because people have no money. You take away people’s pensions, they can’t spend, your economy goes down, and ironically, so do your tax receipts, so you can never catch up, you can never maintain that small deficit, and you can never maintain the limit on debt. So you might be kicked out anyway, unless they change the rules. That’s number one. Number two, the sky doesn’t fall if you’re not in the euro. You know, Greece had the drachma for a long time, that was good enough for Plato, it will be good enough for you and your grandchildren. How does one go about it? The answer is, you issue your own currency again, you re-issue the drachma, you declare it legal tender, that is, the legal currency of the nation, which is good to pay all debts, say initially that one drachma is equal to one euro, and you pay off all the bonds with the drachma that you print, and yes, you will have lawsuits, you will have screaming and hollering, but the truth is, at this point, the European governments and central banks own over 90% of Greece’s public sovereign debt, and therefore you don’t have a lot of private individuals, you’re going to have to bargain with everyone, but you will now be back in charge of your own fate. Argentina did this in 2001, where they were attached to the U.S. dollar, and they unlinked from the U.S. dollar, they refused to pay their international debts, and that’s when the bargaining began, and when the bargaining was over, Argentina was given the chance to not pay back its debts at first, and it recovered so substantially that it ended up paying back $165 billion to debt holders, and until recently they were all quite thrilled and happy. Argentina’s economy zoomed after it told the IMF and the U.S. treasury and the bankers to go to hell, that they were going to use their own currency and not pay those dollar debts.

MN: Greg, some of our listeners have asked, we see another country that’s been doing well economically, Ecuador, and they actually use the U.S. dollar still as their currency. What is different about the case of Ecuador, if anything?

GP: Well, in the case of Ecuador, because they had runaway inflation, the public is afraid to leave the dollar, but their president, whom I know well, who is an economist, Rafael Correa, Correa just said “okay, we’re going to keep the dollar, but we’re not going to pay the debts to these vultures who are charging us usurious interest, terribly high interest. We’re just not going to pay it.” And he did something interesting, because he said he wasn’t going to pay the debts, the debts became close to worthless, just as Greek debt was selling at 30 cents on the euro, 30% of their face value. So his statements knocked down the price of Ecuador’s bonds, and then quietly and secretly, his central bank bought up those bonds at a discount. So in other words, he really learned how to play the system, but he’s an economist, and a fearless, fearless guy, and he was not afraid of the threats of the other governments. Now, of course, you could say that Ecuador has oil. Greece has natural gas, Greece has a lot of resources, and as long as you don’t end up privatizing and selling off your resources because of the crisis, you have the resources to survive without any special help from Europe.

MN: And in terms of the dollarization in Argentina, what was the impact of that on the Argentine economy, before they broke the peg with the dollar?

GP: Well, Argentina, just like Greece and Spain today, had no control over its own fiscal policy. It had no control over its exchange rate because it had set it to the dollar. It could not print money, because it had to maintain a certain ratio with the dollar, so it had no control over its economy, and as a result, the economy collapsed, because the government could not reach to a fall in commodity prices, the fall of copper. So when Argentina had a crisis, because the value of copper fell, they ended up having to sell off everything. They sold off their oil company to Spain, they sold off the Buenos Aires water company to Enron. Teachers were hunting the streets and eating out of garbage cans. There was starvation all over Argentina, which is an agricultural giant, and people were starving! And the IMF told them “austerity, cut your pensions, cut your government payrolls, privatize everything.” And the austerity plan just led to further devastation, because if people lose their jobs in government, if teachers lose their jobs, if policemen lose their pensions, if poor workers lose their jobs and their security, then there’s no one to buy things and your economy continues to fall. So Argentina went through the same thing Greece is going through, except they said “we’ve had enough” and they got out of the dollar trap, they got out of the debt trap by saying we’re not paying, and reorganizing that debt, and since then, their economy has just been stellar, just booming.

MN: We are on the air with investigative journalist and bestselling author Greg Palast here on Dialogos Radio and the Dialogos Interview Series, and Greg, some issues that are often brought up when people discuss what they perceive as the “dangers” of a Eurozone departure for Greece or a unilateral write-off or write-down of Greece’s debt include the risk of capital flight, the possibility that the new currency would be worthless, that Greece would not be able to import anything, that Greek bonds, as you mentioned a few moments ago, are held by official bondholders, other governments and the European Central Bank. To what extent of any of these “dangers” actually legitimate, however?

GP: I can tell you that the moment, because they’ve created such a scare, the European community and most of your Greek leaders, have created such a scare about the euro, it becomes self-creating, at least temporarily. You’re going to go through six months or a year of a very rough time, as some people panic and move their money out of Greece, some companies refuse to operate in Greece or sell you things, but that will switch very quickly. One thing you’re very lucky about in Greece is that you have tourism. The tourism industry is your central source of foreign currency, and as you know, there’s a nation right near you which got very lucky because they weren’t allowed into the EU and the Eurozone, that’s Turkey, because of the lira, Turkey went from having only half your tourism and now you only have half of Turkey’s tourism, because it’s very cheap to vacation in Turkey. So their economy boomed as they took away your tourists. Now you will be able to take away Turkey’s tourists because you’ll have your own currency, and to the extent that there’s flight of some capital holders and some money will leave, that will be replaced as people say “hey, this is a cheap place to vacation,” and if you have guys trying to get their money out by selling industries, you’re going to find a lot of people saying “I think I’ll buy that,” because they saw what happened in Argentina, they saw what happened in Brazil, they saw what happened in the nations that said no to the austerity diktats, they saw what happened to the nations that said no to the debts, to the IMF and to the central banks, and anyone who invested in those nations, like Argentina, Brazil, or Ecuador, made an awful lot of money, and so, given that experience, you’re going to see a lot of investors who are going to say “we’re not going to miss another opportunity…if people are leaving Greece, we’re coming in.” You are going to see a huge flood of investment after a couple of months of panic.

MN: Now, Greg, you’ve done a bit of investigation as well into the role of Goldman Sachs in this whole mess, and particularly the way in which Goldman Sachs helped Greece and, apparently, some other countries as well, essentially cheat their way into the euro. How did this occur?

GP: Yes. By the way, every nation, including Germany, is cheating on the rules of the euro. Germany does not have a 3% deficit, Germany does not limit itself to a debt of 60% of their annual economic activity, Germany cheats, everyone in the Eurozone is cheating. But, when Greece was trying to get into the euro, to pretend that you had 3% deficit, the government hired Goldman Sachs at a fee of nearly half a million dollars, to create a set of phony transactions, fake transactions which were currency swaps between the euros held by your government and the Japanese Yen. There were also some other transactions, but that’s basically what was involved. There’s a bunch of fake transactions to make it look as if your government had somehow earned billions of dollars speculating in the currency markets. It was phony, because the government never made that money, supposedly Goldman Sachs lost that money, but Goldman Sachs doesn’t cut deals where it loses money. In fact, it did quite well. What it was is, the deficit, in all this flim-flam, the real deficit was hidden. And, by the way, Goldman did this for a couple of other countries, and I know J.P. Morgan set up a similar deal for Spain. But Greece was the worst, and when Papandreou got into office, he said “oh my god, we have a big deficit!” I think he knew all along about the flim-flam, but he thought it was economically or politically right to suddenly say “Oh my gosh, we actually have a bigger deficit than we publicly acknowledge.” And, once it became quite public that the deficit was much bigger, and in fact it was a lie, the amount of debt owed by Greece, and that these were all fake transactions, at that point anyone lending money to Greece, of course, is going to demand a huge premium, saying “you guys are committing fraud, you’re all liars, you’re in worse financial condition than you knew,” and so you ended up with bankers demanding 15, 16% interest, which, because you got the euro, you have to pay in, basically, a foreign currency, in Germany’s currency, to pay off these huge, high-interest debts. So Goldman Sachs, remember, they were hired by your government, they didn’t just sneak in back-door. They were brought in by two governments, by two different parties, and defrauded the public, but in coordination with your own leaders.

MN: Now with all the economic developments that have been unfolding in Europe, as well as the recent terrorist incidents, one issue that has been largely shielded from public scrutiny is the proposed Transatlantic Trade and Investment Partnership, or TTIP, which is essentially proposing to create a largely unregulated free-trade zone between the European Union and the United States. If you can, what would such an agreement mean, especially when looking at similar agreements and treaties such as NAFTA or TRIPS or the Trans-Pacific Partnership?

GP: Well the biggest problem for Greece is that, look, Greece has no problem selling olives to Americans or inviting American tourists in. You don’t need a free-trade agreement to trade goods. This is an agreement to trade bads. What I mean by that is that once you open yourself up to this agreement, then once again you are prohibited from barring all sorts of financial operations which are quite dangerous. You can’t restrict currency derivatives trading, you can’t restrict credit default swaps, you can’t restrict banks moving money in and out freely. By the way, to avoid capital flight, Brazil and Argentina actually instituted capital controls, saying “if you’ve removed your money, you’ve committed a crime.” I mean, that’s one way to keep the money in the country when you get out of the euro, to say that you can’t take your money out, it’s illegal. Most of the world, by the way, had rules against moving your money across borders without a good reason, until Ronald Reagan in the 1980s came along. What this does is, it doesn’t create free trade in goods. That you already have in Greece, between Greece and the United States. It is an agreement to create a trade in bads, things you don’t want, toxic assets. And let me tell you: Brazil survived the great 2007-2010 crisis in part because Lula, the left-wing president of Brazil, said no to privatization, no to the elimination of the state banks, and most importantly, Brazil was the only member of the World Trade Organization which refused to sign the financial services agreement saying that international banks could operate in Brazil. He said no way, you can’t sell your toxic assets, your derivatives, you can’t play games with our currency, we are not allowing it. He absolutely refused, and it’s one of the reasons Brazil did so well during the crisis.

MN: Now Greg, before we wrap up, if you had the opportunity to speak to the new prime minister of Greece, Alexis Tsipras, or if he happened to be listening to this interview, what advice would you give him?

GP: Don’t lie. Don’t tell the people that you can tell the Germans “no, we’re not going to accept austerity, and more unemployment, and more cuts to pensions and pay and government services, and stay in the euro.” That’s a lie. If you want to use Germany’s currency, you are under the control of Germany’s finance minister. So make a decision: do you want to be in the euro, or do you want to save Greece? And at this point you can’t have it both ways. You can’t say that you’re going to eliminate the disease of austerity, that you don’t want the leprosy but you want to stay in the leper colony. You can’t stay in the Eurozone. And you have to be honest about it, because you will not be able to tell Europe, or finance minister Schauble of Germany, who is running your country’s finances right now, you’re not going to be able to tell him to go to hell but yes, we want your currency.

MN: Well Greg, thank you very much for taking the time to speak with us today here on Dialogos Radio and the Dialogos Interview Series, and thank you very much as well for sharing your analysis and insights with us.

GP: Thank you very much, Michael.

Please excuse any typos or errors which may exist within this transcript.